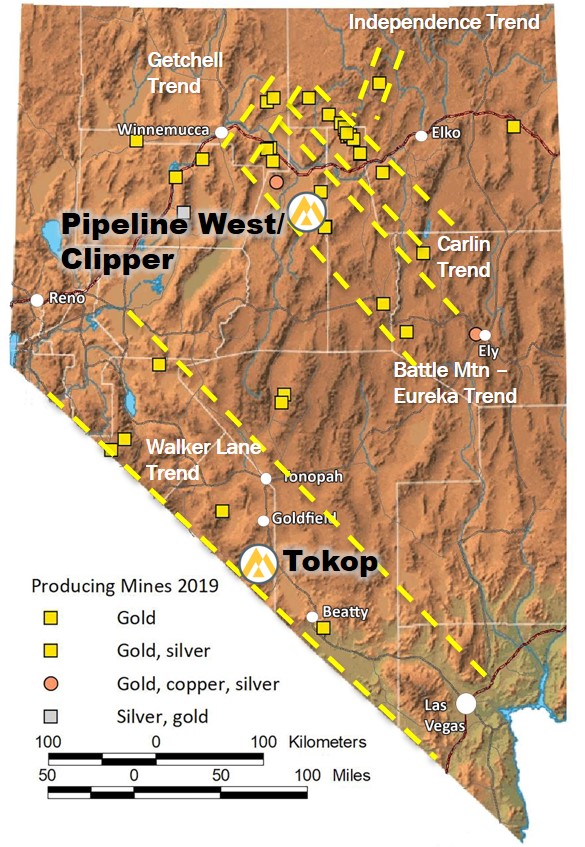

Vancouver, B.C. October 1, 2020 – Riley Resources Corp. (TSX.V: RLY) (“Riley”) or the “Company”) is pleased to announce that it has executed multiple agreements to option and acquire two Nevada gold projects, located within two premier precious metals trends: the Battle Mountain-Cortez-Eureka Trend and the Walker Lane Trend. The Company is also pleased to announce a non-brokered private placement of up to 10,000,000 units at C$0.20 per Unit (“Units”) for total gross proceeds of up to C$2,000,000 (the “Private Placement”).

“We are excited to move Riley forward with projects strategically located within world-class precious metals trends in the mining-friendly State of Nevada. Tokop and Pipeline West/Clipper have very promising mineralization signatures within these trends.”, commented Todd Hilditch, CEO.

Tokop Gold Project:

The Tokop Gold Project (“Tokop”) is located in Esmeralda County (Tokop Mining District), approximately 80 km south of Tonopah. Riley has executed two separate agreements to consolidate two specific claim blocks as well as the assignment of a lease. Deposits currently being mined or developed in the area include: Mineral Ridge Mine, Bullfrog, North Bullfrog, Silicon and the Daisy-Secret Pass deposits. The nearby districts of Tonopah, Goldfield, and Bullfrog (near Beatty, Nevada) have accounted for historical production of more than 8.3 million ounces gold and 143.5 million ounces of silver.

At Tokop, gold mineralisation is hosted in intermediate granitic rocks, similar to that being mined at the Fort Knox Gold Mine near Fairbanks, Alaska. Higher grade gold is hosted in shears, ledges, stockworks, and closely spaced veins within granitic rocks. Potentially bulk mineable, lower grade mineralization can occur peripheral to high grade structures within the intrusives and surrounding altered and hornfelsed carbonates.

Historical Tokop drilling[1] has yielded gold intercepts including: 12.2 meters (m) of 2.5 grams per tonne (gpt); 18.8m of 1.3 gpt; 27.4m of 0.8 gpt and 13.8m of 0.94gpt. Trench sampling away from drilling returned values including 18m of 1.9 gpt gold. Mineralization is open in several directions.

Pipeline West/Clipper Project:

The Pipeline West/Clipper Project (“Pipeline West”) is located in Lander County (Cortez Mining District), approximately 80 km southwest of Elko, Nevada. Nearby gold deposits include Barrick’s ‘Cortez Complex’ (operated under the Nevada Gold Mines JV): Pipeline; Gold Acres; Cortez; Cortez Hills; Goldrush and Four Mile.

Pipeline West lies just 5 km west of the Pipeline Mine and only 3 km west of the Gold Acres window into carbonates of the lower plate of the Roberts Mountains Thrust. Exploration at Pipeline West will target lower plate carbonates. No drilling deeper than 250 meters has ever been conducted within most of the property.

Property locations:

Private Placement:

Riley is pleased to announce a non‑brokered Private Placement of up to 10,000,000 Units at a price of C$0.20 per Unit, for total gross proceeds of up to C$2,000,000. Each Unit will be comprised of one common share of the Company (a “Share”) and one-half of one share purchase warrant (a “Warrant”). Each whole Warrant will entitle the holder thereto to purchase for a period of twenty-four (24) months one additional Share (a “Warrant Share”) at an exercise price per Warrant Share of C$0.40. If the closing price of the common shares of Riley quoted on the TSX.V is greater than C$0.60 for 10 consecutive trading days, Riley may accelerate the expiry date of the Warrants to the 30th day after the date on which Riley gives notice to the Warrant holders of such acceleration.

All securities issued under the Private Placement will be subject to a hold period of four months and one day from the closing date. The Company may pay finders’ fees in cash and issue finder’s warrants. The Private Placement and finders’ fees are subject to regulatory approval.

Net proceeds of the Private Placement will be used for exploration, corporate development and general working capital purposes, including to make the cash payments and work commitments under the MLOP Agreement, the PA and the Option Agreement discussed below.

Commercial Terms Overview:

Tokop Gold Project:

The Company has entered into a Mining Lease and Option to Purchase Agreement (“MLOP Agreement”) with Nevada Mines LLC (“Nevada Mines”), whereby Nevada Mines will lease and grant the option to purchase its 100% interest in certain patented and unpatented mining claims (“Nevada Property”) located in Esmeralda County, Nevada. The MLOP Agreement has an initial term of 5 years whereby the Company must incur minimum lease payments of US$225,000 (US$25,000 payable in year 1) and work commitments of US$650,000 (US$50,000 to incur within the first 2 years). The Company has the option of extending the MLOP Agreement for 2 additional 5-year terms whereby the Company must incur minimum lease payments of US1,000,000 in the second term and US$2,500,000 in the third term. There are no work commitment requirements in the second and third terms. The Company shall grant Nevada Mines a net smelter returns (“NSR”) royalty of 4.0% on the Nevada Property.

The Company has an option to purchase one half of the 4.0% NSR royalty (2.0%) at any time for US$4,000,000. The Company has the option to purchase the Nevada Property outright for US$4,000,000 prior to or on the tenth anniversary of the execution of the MLOP Agreement and for US$6,500.000 prior to or on the fifteen anniversary of the execution of the MLOP Agreement.

The Company has also entered into a Purchase Agreement (“PA”) with Ioneer USA Corporation (“Ioneer”) to acquire a 100% interest in Ioneer’s Tokop claims which consists of leased patented mining claims, leased unpatented mining claims and owned unpatented mining claims located in Esmeralda County, Nevada. Under the PA, the Company must pay US$28,000 (US$13,000 paid to date) and grant Ioneer an NSR royalty of 0.5% on certain Tokop unpatented mining claims which the Company has an option to purchase at any time prior to commercial production for US$500,000. The majority of the Company’s mineral interests acquired under the PA are subject to an additional 2.5% NSR royalty payable to various parties.

Pipeline West/Clipper Project:

The Company has entered into an Option Agreement (“Option Agreement”) with Desert Pacific Exploration, Inc., MinQuest Ltd. and two individuals (collectively the “Parties”), whereby the Parties have granted Riley the option to purchase a 100% interest in certain patented and unpatented mining claims located in Lander County, Nevada. The Option Agreement has a term of 10 years whereby the Company must incur minimum lease payments of US$1,010,000 (US$35,000 payable within the first year) and work commitments of US$2,650,000 (US$200,000 to be incurred within the first 3 years).

On completion of the option exercise, the Company shall grant to the Parties a 3.0% NSR royalty on certain unpatented mining claims and a 1.5% NSR royalty on certain patented mining claims.

Proposed Name and Symbol Change:

Riley Resources Corp. has proposed to change its name to Riley Gold Corp. and update its trading symbol to “RLYG”, upon approval of the TSX.V. An additional news release will be issued in due course announcing the effective date of the name and symbol change.

Qualified Person:

This news release has been reviewed and approved by Charles Sulfrian, CPG., Consulting Geologist, of Riley and a ‘qualified person’, as defined by National Instrument 43-101,Standards of Disclosure for Mineral Projects. The Qualified Person has not completed sufficient work to verify the historic information on Tokop, particularly in regards to the historical drill results. However, the Qualified Persons believe that drilling and analytical results were completed to industry standard practices. The information provides an indication of the exploration potential of Tokop but may not be representative of expected results.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Todd Hilditch

Chief Executive Officer

Tel: (604) 443-3831

Toll free: 1 877 792-6688 Ext 2

Fax: (604) 682-3860

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Statements

This press release contains statements which constitute “forward looking information” under applicable Canadian securities laws, including statements regarding the completion of the Private Placement, the acquisition by the Company of the claims under the MLOP Agreement, the PA and Option Agreement, as well as plans, intentions, beliefs and current expectations of the Company, its directors, or its officers with respect to the future business activities of the Company. The words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” and similar expressions, as they relate to the Company, or its management, are intended to identify such forward-looking information. Although Riley believes that the expectations reflected in these forward-looking statements are reasonable, undue reliance should not be placed on them because Riley can give no assurance that they will prove to be correct. Since forward looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties and the Company’s future business activities may differ materially from those in the forward-looking information as a result of various factors, including, but not limited to, fluctuations in market prices, successes of the operations of the Company, continued availability of capital and financing and general economic, market or business conditions and the ability to obtain the requisite approvals of the TSX Venture Exchange, or failure to meet other conditions to closing, to the transactions reflected in this press release. The Private Placement and other transactions may not be completed at all if these approvals are not obtained or some other condition to the closing is not satisfied. Investors are cautioned that any such forward-looking information is not a guarantee of future business activities and involves risks and uncertainties. Additional information on these and other factors that could affect Riley operations and financial results are included in reports on file with Canadian securities regulatory authorities and may be accessed through the SEDAR website (www.sedar.com).There can be no assurances that such information will prove accurate and, therefore, readers are advised to rely on their own evaluation of such uncertainties. The Company does not assume any obligation to update any forward-looking information except as required under the applicable securities laws.